Kingfisher releases final results for the year ended 31 January 2022

Published: 22 March 2022 - Neil Mead

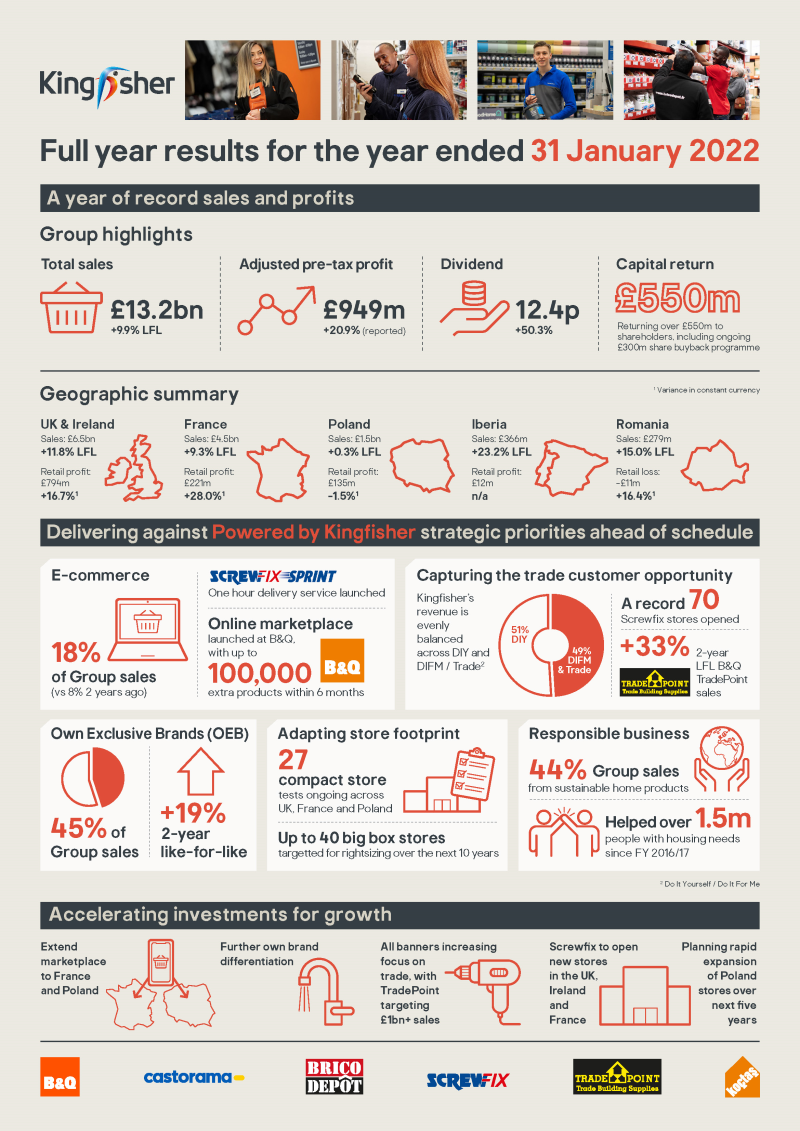

Kingfisher has released its final financial results for year ending 31 January 2022.

Highlights for the year include: a year of record revenue and profits; gaining market share in the UK and France; effective management of product availability, supply chain and inflation pressures; delivering against strategic priorities ahead of schedule; accelerating investments for growth – digital, trade proposition, Screwfix and Poland expansion; ambitious new target set for sales of sustainable home products; returning over £550m to shareholders, including dividends and ongoing £300m share buyback; and new trends in home improvement and continued strategy delivery support long-term growth.

Thierry Garnier, Chief Executive Officer, said: “Kingfisher has delivered a year of very strong financial performance. We saw growth in all banners and categories, with resilient demand from both DIY and DIFM/trade segments – each representing 50% of Group sales. We continue to leverage our stores assets and Group technology to drive forward our e-commerce proposition, with faster click & collect and home delivery, and broader product choices for our customers. 18% of our sales are now made online, which is ten percentage points higher than two years ago. B&Q had an outstanding year, with sales passing £4bn. It was also a record year of expansion for Screwfix, with 70 new stores opened in the UK and Ireland, and Screwfix France showing very promising early progress.

“For the year ahead, while the macroeconomic and geopolitical environment is uncertain, you can expect from us continued focus on top line delivery and market share growth, strong execution, effective management of our gross margin, and active and responsive management of our operating costs.

“We are now over two years into our new strategy and execution is ahead of schedule. With the business in a strong position, we are accelerating our investments for growth – through the launch of our scalable e-commerce marketplace, the expansion of Screwfix in the UK and France, new store openings in Poland, and our plans to increase our trade customer base. Looking forward, we are confident that these investments, supported by continued strong execution and the new demand-drivers we are seeing in our industry, will drive faster growth in sales, profit and free cash flow.”

FY 21/22 Group results

• Sales up 9.7% in constant currency, driven by strong demand across both retail and trade channel

• LFL sales up 9.9% and corresponding 2-year LFL* up 18.1%

- Strong performances in the UK & Ireland*, France*, Iberia* and Romania; Poland impacted by COVID-related store closures in Q1 21/22

- Transaction volume and average basket value both up on 1-year and 2-year basis

- LFL sales up 13.7% in Q4 21/22 on a 2-year basis; 1-year LFL down 1.7% and better than Q3

• E-commerce sales* up 5.3% (2-year growth up 171%); omni-channel engagement remains high

- E-commerce sales 18% of Group sales (FY 20/21 and FY 19/20: 18% and 8%, respectively)

• Retail profit up 16.7% in constant currency, driven by strong growth in UK & Ireland and France

• Statutory pre-tax profit up 33.1%, reflecting higher operating profit, and lower net finance costs and more favourable adjusting items* before tax

• Adjusted pre-tax profit up 20.9%, reflecting higher retail profit and lower net finance costs

• Free cash flow of £385m, down 59.0% (FY 20/21: £938m; FY 19/20: £191m), largely reflecting expected reversal of inventory-driven working capital inflow in prior year

• Net decrease in cash of £237m (FY 20/21: net increase in cash of £881m), largely reflecting lower free cash flow, and outflows in relation to ordinary dividends and share buybacks

• Net debt to EBITDA* of 1.0x as at year-end (31 January 2021: 0.9x)

• Total dividend per share proposed of 12.40p (up 50.3%; FY 20/21 total dividend: 8.25p)

Outlook for FY 22/23

• Encouraging start to Q1 22/23:

- Q1 22/23 LFL sales (to 19 March 2022)(3) down 8.1%, with 2-year LFL up 16.0%

- Resilient demand across all markets supported by good stock availability

- Strong ‘big-ticket’ demand, with current showroom order book for B&Q and Castorama France 72% higher YoY, and up 79% on a 2-year basis

• Mindful of heightened macroeconomic and geopolitical uncertainty that has emerged since the start of the year

• Expect continued strong execution:

- Targeting further market share growth

- Anticipate net space growth of c.+1.5%, largely from Screwfix and Poland

- Committed to continued effective management of our gross margin in an inflationary environment, and active and responsive management of our operating costs*

- Expect P&L investment of c.£25m in relation to our new businesses, including Screwfix France and B&Q’s e-commerce marketplace

• Based on the above, we are comfortable with the current consensus of sell-side analyst estimates for FY 22/23 adjusted pre-tax profit(4)

• Target dividend cover* of 2.25 to 2.75 times; on track to complete remaining £75m share buyback by May 2022